Financial Planning

A Strategic Plan for Your Financial Future

Financial planning is more than just saving money—it’s about creating a clear, actionable strategy that aligns with your goals, lifestyle, and future aspirations. At WealthWorks Financial, we take a comprehensive approach to financial planning, ensuring that every piece of your financial puzzle works together—from retirement planning and investments to tax strategies and insurance protection.

Whether you’re just starting out, preparing for retirement, or looking to build long-term wealth, our step-by-step financial planning process will help you gain clarity and confidence in your financial future.

What’s Included in a WealthWorks Financial Plan?

Our comprehensive financial planning services cover all aspects of your financial life to help you build, grow, and protect your wealth.

Retirement Planning

Ensure long-term financial security with a structured savings and income strategy

Investment Planning

Build a diversified portfolio that aligns with your risk tolerance and goals

Tax Planning

Optimize your tax strategy to reduce liabilities and maximize savings

Insurance & Risk Management

Protect yourself and your family with customized insurance solutions

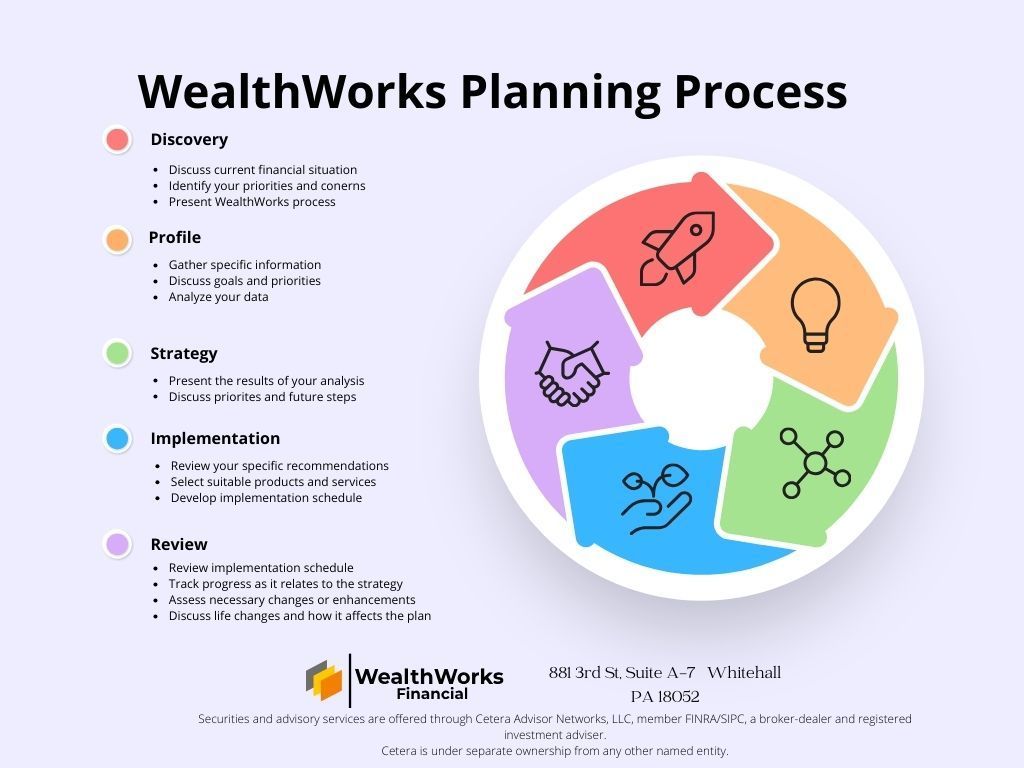

Our Financial Planning Process

We believe financial planning should be simple, structured, and stress-free. That’s why we take a methodical approach, helping you navigate each stage of your financial journey.

How We Build Your Financial Plan

- Discovery: Understanding your current financial situation, priorities, and long-term goals

- Personalized Asset Map: Visualizing your financial landscape so you can see where you stand

- Customized Strategy: Creating a plan that covers retirement, investments, tax planning, and insurance

- Implementation: Putting your financial plan into action with clear, actionable steps

- Ongoing Support & Adjustments: Reviewing and refining your plan as your needs evolve

Common Questions About Financial Planning

Who needs financial planning?

Everyone can benefit from financial planning—whether you’re just starting your career, planning for retirement, or looking to build generational wealth. A financial plan provides clarity, structure, and confidence in managing your money.

How often should I update my financial plan?

Your financial plan should be reviewed at least once a year or whenever a major life event occurs, such as a job change, marriage, home purchase, or retirement.

What if I already have investments? Do I still need financial planning?

Yes! While investments are a key part of financial success, they are just one piece of the puzzle. A solid financial plan ensures that all aspects of your wealth—including taxes, retirement, and insurance—are working together effectively.

Is financial planning only for wealthy individuals?

Not at all! Financial planning is for everyone. No matter your income level, having a structured financial strategy can help you make better decisions, reduce financial stress, and set you up for long-term success.